The Trump Doctrine & U.S. National Security

Assessing the Trump Doctrine, Coherence, and Constraint in 2025

Despite sustained criticism from diplomatic, academic, and international policy communities, U.S. foreign and national security administration in 2025 exhibited a notable degree of internal coherence when assessed through an administrative realist lens. Rather than reflecting ad hoc decision-making or ideological drift, the year’s major actions—ranging from the use of force against Iranian nuclear infrastructure to alliance burden recalibration, cyber deterrence reforms, and Taiwan-related defense administration—were largely consistent with a governing logic centered on constraint, deterrence, and institutional capacity. This approach prioritized clear objectives, defined thresholds for action, and maintained credible response capabilities over aspirational outcomes or consensus-driven processes.

Viewed in this way, 2025 does not represent a departure from rational administration but an illustration of how national security governance operates under conditions of uncertainty, limited control, and asymmetric risk. Decisions were shaped less by the pursuit of ideal end states than by assessments of what institutions could plausibly execute and sustain. This review examines key 2025 national security actions as administrative cases, evaluating whether organizational design, decision authority, and readiness posture aligned with stated purposes. The analysis emphasizes mission clarity, interagency coordination, decision latency, and deterrence as an ongoing posture, drawing on publicly available evidence to assess administrative performance rather than political narrative.

U.S. Strike on Iranian Nuclear Sites (June 2025)

In June 2025, the U.S. conducted a precision strike on three Iranian nuclear facilities (Fordow, Natanz, and Isfahan) as part of a broader Iran–Israel conflict. The operation—dubbed Operation Midnight Hammer—was carried out by U.S. Air Force and Navy assets using bunker-buster bombs (GBU-57A/B MOPs) from B-2 bombers and dozens of Tomahawk cruise missiles. The mission’s aim was clearly defined: “to destroy or severely degrade Iran’s nuclear program,” according to CRS reporting. U.S. officials described the strikes as “very narrowly tailored” to impede Iran’s uranium enrichment capacity. In announcing the action, President Trump asserted that Iran’s key enrichment facilities had been “completely and totally obliterated.” The Department of Defense reported that initial battle-damage assessments showed the sites sustained “extremely severe damage,” and a July 2025 Pentagon review estimated Iran’s program set back by roughly two years.

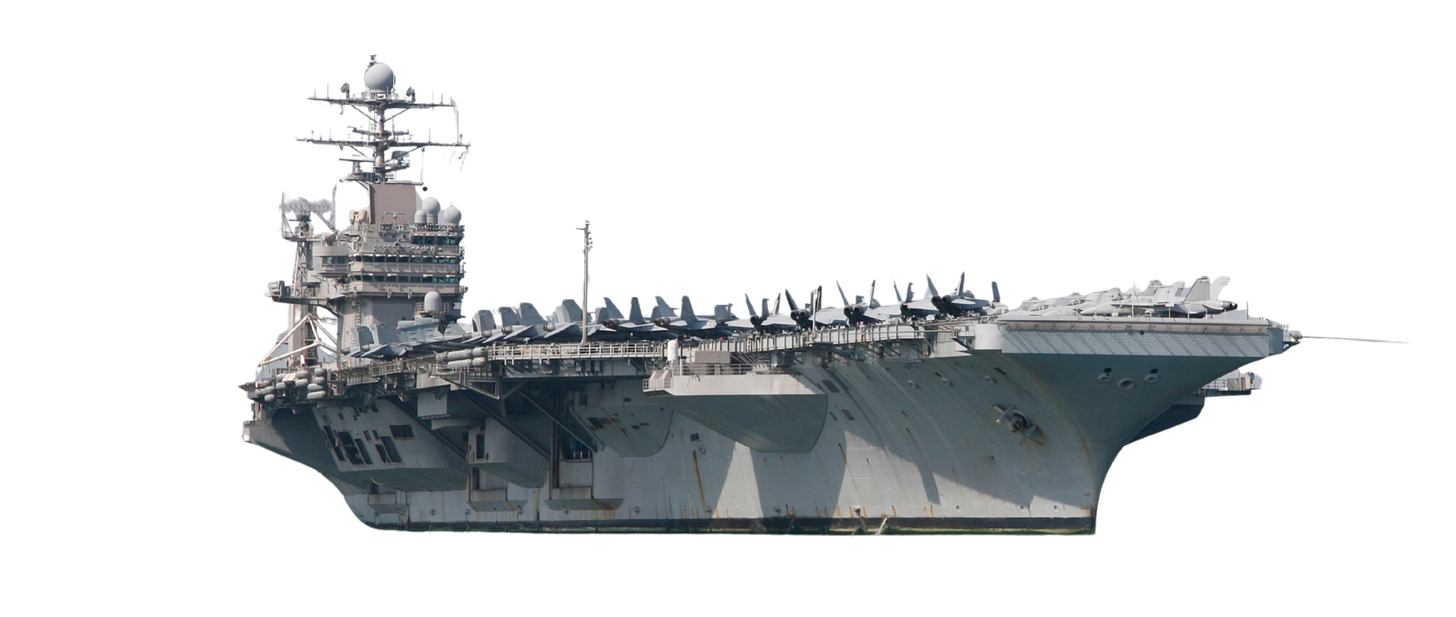

The administration’s decision-making process combined diplomatic, intelligence, and military inputs. President Trump had publicly signaled a decision “within the next two weeks” after Israel’s attacks on Iran on June 13. The June 22nd strike entailed coordination among U.S. commands: over 125 aircraft (including seven B-2s) and a U.S. submarine were integrated under U.S. Central Command oversight. National Security Council and interagency reviews evidently “narrowly tailored” the target set, reflecting mission clarity at the political and military levels.

Institutional readiness and responsiveness were evident in the rapid assembly and deployment of specialized forces. The use of heavy MOP bombs and stealth bombers—assets maintained in advanced readiness—indicates that U.S. air and naval forces were prepared to execute complex strikes at short notice. Intelligence and special operations units also supported targeting and battle-damage assessment. In this operation, the chain of command (from the President through the Secretary of War and CJCS) functioned efficiently: Gen. Dan Caine (CJCS) later briefed that all three targets were heavily damaged.

Strategic clarity and outcomes were generally aligned. The strike’s objective was not regime change, but the preservation of regional security via nuclear delay. Indeed, U.S. and Israeli leaders intended the action to deter further nuclear development while coercing Iran back to negotiations. The two-year setback in enrichment capability was a concrete performance metric. However, deterrence—defined here as the imposition of credible costs rather than immediate behavioral compliance—was necessarily partial and contingent. Iran retaliated the next day by firing missiles at a U.S. base in Qatar, prompting an immediate call for Iran to ‘make peace’ and a unilateral strike pause by the U.S. president. This sequence underscores that deterrence was treated as a posture: the U.S. imposed costs on Iran while assuming no immediate Iranian compliance. As one RAND analyst observed, the strike’s “concrete strategic objective” was to impede Iran’s nuclear capabilities, yet the larger conflict required continued vigilance. In sum, the Iran strike demonstrated strong operational readiness and interagency coordination, achieved measurable technical effects, and operated within explicitly constrained goals that treated partial deterrence as an acceptable, pragmatic, realist outcome.

NATO Force Posture and Funding

In 2025, NATO allies undertook significant shifts in defense planning and financing. At the June 2025 Hague summit, heads of government endorsed a dramatically higher spending pledge. With the exception of Spain, Allies committed to invest up to 5% of GDP annually by 2035 on core defense and related security (at least 3.5% of GDP for core defense requirements, plus up to 1.5% of GDP for defense- and security-related spending—5% total—by 2035). This replaced the previous 2% guideline from 2014. The change was primarily a political signal of renewed emphasis on deterrence; analysts note it was “hailed as ‘historic’” and intended to reassure the U.S. on burden sharing.

Administratively, NATO’s decision-making on funding involves both collective bodies and national governments. The North Atlantic Council (NAC) set the broad target, while each ally must adjust its own budget. The 2025 pledge required concrete follow-through via the NATO Defence Planning Process (NDPP). As part of NDPP, strategic commands identified a ‘minimum capability requirement’ pool for European defense, and the summit agreed to increase these targets by about 30% to meet new regional plans. The burden of this increase fell mainly on European countries and Canada, since U.S. leaders signaled a reorientation to Asia and a willingness to “assume risk in other theaters.” In effect, U.S. reliance on European defense infrastructures (e.g., ISR, refueling, heavy airlift) was explicitly acknowledged as shifting. Secretary of Defense Hegseth stated that “strategic realities prevent the US from taking primary responsibility for European conventional deterrence,” underscoring a devolution of responsibility to allies.

Performance and readiness under these commitments remain uneven. In 2025, all NATO allies were expected to meet or exceed the old 2% norm, and European Allies and Canada collectively reached about 2.02% of GDP in 2024. The common NATO budgets (civil and military) totaled roughly €4.6 billion for 2025, rising to an estimated €5.3 billion for 2026, to fund headquarters and shared capabilities. Nonetheless, actual force contributions vary: full implementation of the new “5%” ambition would require a sustained upward trajectory and efficient capital investment. For example, meeting NATO’s higher readiness goals entails providing up to 500,000 troops at various readiness levels, as measured by the NATO Force Model. Individual allies must adapt their forces accordingly under the new NDPP targets. In practice, resource constraints and political cycles limit how rapidly these forces can be fielded.

Institutional trade-offs are apparent. Higher nominal spending does not automatically translate into the necessary capabilities; as SIPRI analysts cautioned during the June 2025 Hague Summit, inputs (budget shares) are not perfect indicators of outputs (combat-ready units). NATO processes must ensure additional funds are directed to verified needs—such as the 2025 Capability Targets—rather than simply meeting percentage targets. The administrative challenge remains the alignment of national defense plans with alliance requirements. This is managed through the NATO Defence Planning Process (NDPP)—led by the Defence Policy and Planning division and the Military Committee—which seeks to enforce this alignment. Ultimately, 2025 saw NATO reinforce its deterrence posture, but meaningful evaluation will depend on implementation metrics like force availability and adherence to the new readiness cycles.

Cyber Defense and Deterrence

Cybersecurity remained a priority domain in 2025, blending military, intelligence, and civilian policy. U.S. cyber defense efforts emphasized both capacity building and deterrence signaling. On the organizational side, the Pentagon launched a revamped force-generation model for cyber forces under the banner “CYBERCOM 2.0.” The intent was to treat cyber personnel as specialists rather than rotating roles. Under CYBERCOM 2.0, U.S. Cyber Command would integrate more tightly with the service branches to “recruit, assess, select, train, and retain” dedicated cyber warriors. In essence, authority over cyber force generation was centralized: the CyberCOM commander was granted new Title 10 powers over mission-specific training and assignment, while the Services retained basic recruitment responsibilities. Officials explained that this model “focuses on delivering immediate warfighting outcomes,” embedding a “warrior ethos” in cyber forces. Top Pentagon leaders like Under Secretary Colby and Under Secretary Tata publicly lauded the reforms as increasing “lethality” and ensuring the U.S. can “respond decisively” in cyberspace.

Legislatively and diplomatically, the administration sought to harden deterrence. In late 2025, Congress proposed the Cyber Deterrence and Response Act, creating a government-wide framework for attributing cyberattacks and sanctioning foreign hackers. The bill aimed to standardize how agencies identify hostile cyber actors, and authorized “robust sanctions” (asset freezes, export controls, visa bans) against them. Similarly, the National Cyber Director’s office signaled a shift toward “offensive, responsive” cyber strategy—explicitly to “introduce costs and consequences” for adversaries. These moves reflected a more assertive posture: U.S. officials noted that growing bipartisan sentiment (including Trump allies in Congress) demanded stronger retaliation options, especially against China’s cyber activities.

However, implementation and readiness gaps persisted within an institutional environment explicitly undergoing structural consolidation rather than policy reversal. Experts argued that simply raising budgets or drafting new policies would not quickly resolve talent shortages or integration issues. War analysts noted that the revised CYBERCOM model was “still relying” on traditional service career systems, and some analysts called it only a “minor tweak” that did not fully fix root problems of the Cyber Mission Force. Moreover, U.S. cyber strategy continued to reflect bureaucratic politics: intelligence agencies generally favor cautious espionage-based approaches, while military elements push for aggressive disruption and overt deterrence. In practice, U.S. cyber operations in 2025 combined elements of both: clandestine counter-hacking and public denunciations of state hackers.

Deterrence posture in cyberspace thus came to mean establishing clear signaling mechanisms and improving response speed, rather than achieving agreed objectives (which are hard to define in the cyber realm). The legislative and organizational reforms of 2025 are geared toward shortening the decision latency in response to attacks. By unifying attribution channels and empowering CyberCOM, the U.S. aims to “respond decisively” when adversaries act. Empirical assessment of these efforts will necessarily depend on future events (such as preventing large-scale intrusions or materially degrading malicious actors). For now, the structural changes underscore a recognition of constraints: cyber operations span multiple agencies (DOD, DHS, Justice, State), and centralizing procedures was deemed necessary to overcome interagency lag and enhance agility.

Taiwan-Related Defense Administration

U.S. policy toward Taiwan in 2025 continued to balance deterrence against China with an insistence on Taiwanese self-reliance. A signature development was Washington’s arms sale to Taiwan and concurrent pressure on Taipei to invest more in its own defense. In mid-2025, the U.S. approved a large $11.1 billion arms package for Taiwan, signaling support. However, senior U.S. officials also openly urged Taiwan to share the burden. In March 2025, Elbridge Colby, U.S. Under Secretary of War for Policy publicly admonished Taipei for spending “well below” 3% of GDP on defense and demanded an approximately fourfold increase. These comments reflected a “burden-sharing” principle akin to that of NATO allies: the U.S. readiness to defend Taiwan was increasingly framed as conditional on Taiwan’s own efforts. The administration even momentarily paused some military aid to negotiate trade with China, underscoring a transactional view of the security relationship.

Taipei responded by raising its defense budget. The Taiwanese government signaled a plan to exceed 3% and reach about 3.3% in 2026. From an administrative standpoint, this illustrates a clear cause-and-effect: U.S. pressure (and the threat of withholding support) induced Taiwan to prioritize military spending. However, even with these increases, U.S. policymakers privately expressed concern that Taiwan still fell short of expectations. In diplomatic signaling, the Trump administration returned to a deliberate strategic ambiguity: public U.S. statements stopped short of outright guarantees, and emphasis was placed on Taiwan’s resilience and deterrent posture.

Regional events tested this posture. In late December 2025, China launched a massive exercise (“Justice Mission–2025”) around Taiwan, including missile launches near the 24-nautical-mile line (contiguous zone) to the north. PRC officials described the drills as a “punitive and deterrent action” against Taiwanese moves toward independence. U.S. reaction was understandably muted; President Trump downplayed the exercise’s significance, citing his personal rapport with Xi Jinping (“he hasn’t told me anything about it… I don’t believe he’s going to be doing it”). This public stance reflected the administration’s approach: reliance on elite backchannels and deterrence-by-default rather than immediate reaction. Allies like Japan expressed concern that the drills “increase tensions,” but the U.S. stood by its message of restraint.

In administrative terms, the Taiwan example underscores trade-offs and the need for mission clarity. The U.S. clearly defined one mission: prevent a Chinese conquest of Taiwan. But the means chosen emphasized defense partnership over direct intervention. Mixed signals intentionally bounded strategic clarity: pressing Taiwan to stand up more of its own defense suggests U.S. commitment is not unconditional. Command integration in the Taiwan context is largely bilateral (through the State Department’s American Institute in Taiwan and Pacific Command structures) rather than a unified NATO-style framework. Ultimately, Taiwan-related decisions in 2025 were characterized by institutional realism: policymakers weighed the risk of great-power war against the benefit of deterrence. They leaned on Taiwan’s self-help and existing security arrangements, rather than broadly committing significant U.S. resources in line with a cautious, posture-based deterrence philosophy.

2026 and Beyond: Administrative and Institutional Imperatives

Looking ahead, the 2025 experience suggests several imperatives for U.S. national security administration. First, clarity of objectives must remain paramount. The contrast between well-defined goals (e.g., degrading Iran’s nuclear program) and vague ends (the longer-term Iran–Israel conflict or the abstract notion of “stability”) underscores the need to tie actions to measurable outcomes. Agencies should codify clear mission statements at the outset of operations and metrics (e.g., capability setbacks, readiness indices) to evaluate success.

Second, administrative readiness requires ongoing investment. The reforms of 2025—NATO funding pledges, cyber force development, Taiwan contingency planning—must be translated into actual capabilities. This means sustained training cycles, maintenance of critical platforms, and robust logistics. Policymakers should develop performance data on response times and force availability. For example, the Department of War might track and/or reduce the decision latency between the detection of a threat and the initiation of action (in cyber or missile defense), identifying bottlenecks in the national security interagency process. Streamlining authorities (as done with CYBERCOM 2.0) and regular joint exercises can reduce these delays.

Third, strategic alignment and burden sharing must be institutionalized. The 5% spending commitment and Taiwan’s rising budgets show willingness to share costs, but formal mechanisms are needed to ensure compliance. Congress and the Executive should codify contribution plans and ensure that resources match the new strategic priorities. In NATO, continued consensus on capability targets and the NATO Force Model will force allies to field real units at readiness. Domestically, U.S. agencies must work across secretariats (War (Defense), State, Commerce, etc.) in areas such as cyber attribution frameworks and export controls to present a unified front. Wargaming and joint planning across agencies could enhance alignment.

Finally, the deterrence posture should be maintained as a stance of strength. Deterrence cannot guarantee outcomes, but it requires visible capabilities and resolve. This implies keeping forces forward-deployed where credible (in the Indo-Pacific and Europe) and making rules of engagement and red lines understood to adversaries (even if privately). Administrative realism dictates avoiding idealistic overreach: policy should focus on achievable limits (e.g., delaying a nuclear program, defending NATO territory) rather than on nation-building or force projection beyond clear national interest.

In sum, 2025’s national security operations reveal that robust performance hinges on realistic priorities and strong institutions. Continued attention to resource allocation, clear mission clarity from leadership, and nimble but disciplined coordination will be essential as 2026 unfolds.

.